Real Estate Tax Appeals Alert | NOW is the Time to Consider a Property Tax Appeal!

January 23, 2024

If a town where you pay real estate taxes is undergoing a revaluation or reassessment, it is imperative to review whether or not you should file a real estate tax appeal this year. Property owners (i.e. commercial office buildings, retail space, multifamily properties, restaurants, hospitality properties, industrial and warehouse/storage complexes) may be eligible for a decrease in property tax assessment due to market changes over the past several years. If you are experiencing lower rent, higher vacancy, or operating expenses for these types of properties, Brach Eichler may be able to help you obtain a reduction in your 2024 property taxes.

Every property owner should carefully review your 2024 assessment to determine if an appeal is appropriate. Brach Eichler attorneys thoroughly review every case before filing an appeal so that we only file appeals that we preliminarily determine will reduce taxes. Our preliminary review is at no cost or obligation. Many of our cases result in a substantial reduction in tax either through settlement or trial. We have over 50 years of experience prosecuting real estate tax appeals.

If we can assist in reducing your property tax liability please give us a call for a no-cost review of your assessment. Our Brach Eichler team has significant experience prosecuting and defending appeals in New Jersey and Pennsylvania on behalf of all types of property owners.

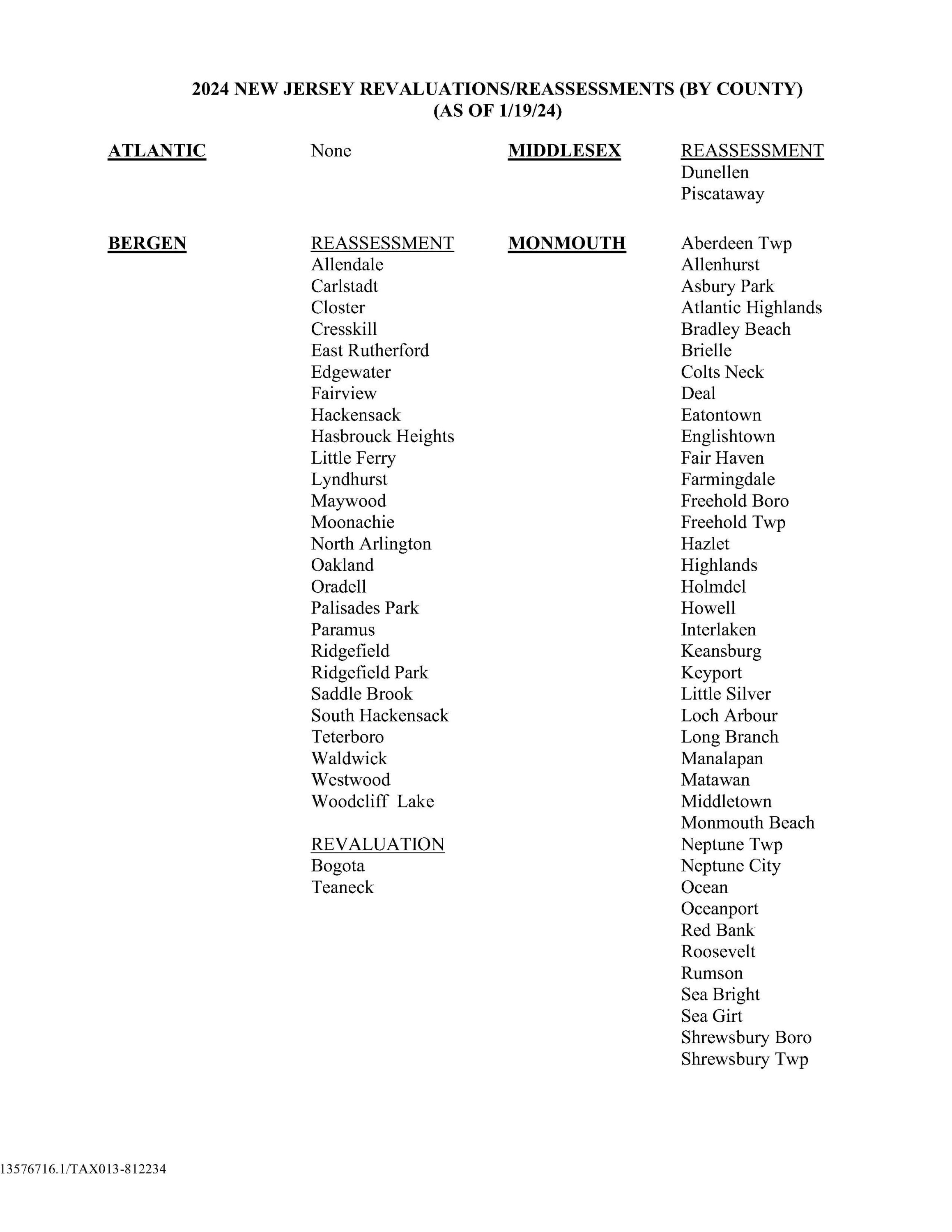

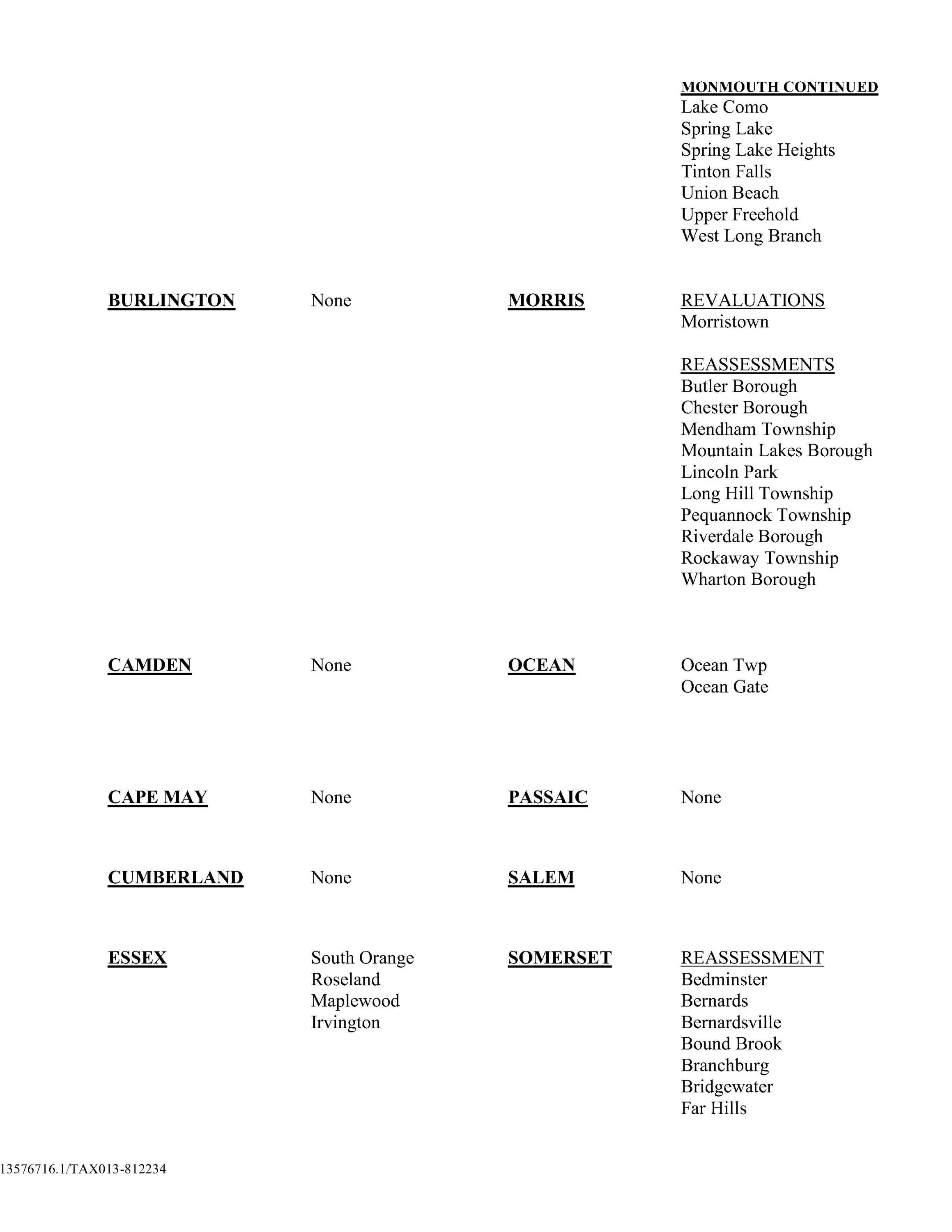

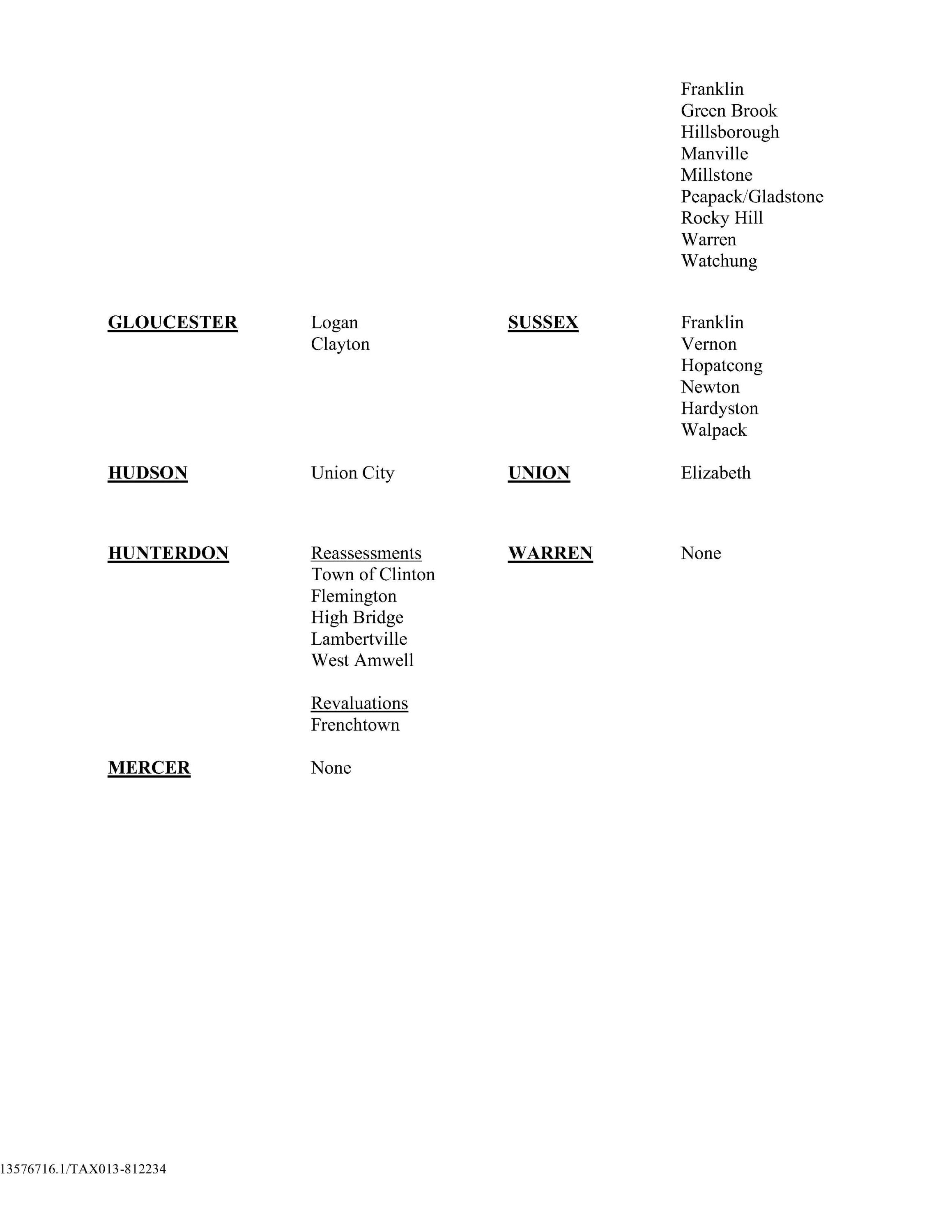

The filing deadline for 2024 tax appeals is April 1, 2024 (if a property is located in a revalued or reassessed district, the filing deadline is May 1, 2024). Click here to view a tentative list of municipalities currently scheduled for revaluations/reassessments in 2024. If you would like an immediate, no-cost review of your tax assessment or if you receive a complaint from a municipality seeking to increase your tax assessment, please contact Daniel Pollak at 973-403-3119 dpollak@bracheichler.com, Allen Popowitz at 973-403-3134 apopowitz@bracheichler.com, or Alan Hammer at 973-403-3113 ahammer@bracheichler.com as soon as possible so that we can assist you.

2024 NEW JERSEY REVALUATIONS/REASSESSMENTS (BY COUNTY)

(AS OF 1/19/24)

Related Practices: Real Estate Tax Appeals

Related Attorney: Daniel J. Pollak, Allen J. Popowitz, Alan R. Hammer

Related Industry: Real Estate