*No aspect of this advertisement has been approved by the Supreme Court of New Jersey.

Click here for the Awards and Honors Methodology.

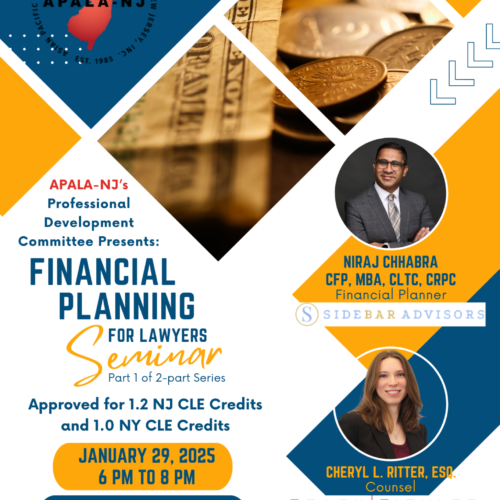

Cheryl Ritter assists clients in the development and implementation of estate and gift planning matters including wills, trusts, financial powers of attorney, living wills, and health care agent designations. In this role, Cheryl counsels individual clients on the tax-efficient transfer of wealth using a variety of strategies, including dynasty trusts, life insurance trusts (individual and survivorship), qualified personal residence trusts, grantor retained annuity trusts, charitable trusts, limited liability companies, and sales to intentionally defective grantor trusts, among others. Cheryl develops estate plans tailored to the specific needs and goals of each client, considering factors such as the unique asset mixes of high-net-worth individuals and the distinct relationships within clients’ families.

Cheryl is also experienced in trust and estate administration and has researched and addressed complex issues with respect to income taxation of trusts and estates. Additionally, she has been involved with the preparation of necessary federal and state tax returns, including estate tax, gift tax, and generation-skipping transfer tax returns, as well as post-mortem tax planning strategies, such as disclaimers.

Prior to joining Brach Eichler, while a law student at Seton Hall University School of Law, Cheryl served as an extern for the Internal Revenue Service, Office of Chief Counsel, researching significant tax issues.

AWARDS

PROFESSIONAL ACTIVITIES

- Member, American Bar Association

- Member, New Jersey State Bar Association